Owners Draw Quickbooks Desktop

Select an account to categorize what the owner bought for the business. Any money an owner draws during the year must be recorded in an owner’s draw account under your owner’s equity account.

Owners Draw Balances

Making general journal entries 6.

Owners draw quickbooks desktop. Owners draws or withdrawals is never an expense. Enter the owner as the vendor. At the bottom left choose account > new.

You have customer invoices (a/r) and vendor invoices (a/p) accounts to create invoices. An owner’s investment, on the other hand, is money that you transfer out of your personal bank account and into your business’s account. The use of credit card rewards to credit a purchase.

Viewing your company information 2. Pay the bill later by clicking create (+) > pay bills. Details to create an owner's draw account:

To record owner’s draws, you need to go to your owner’s equity account on your balance sheet. Using the to do list 4. An owner's drawing is not a business expense, so it doesn't appear on the company's income statement, and thus it doesn't affect the company's net income.sole proprietorships and partnerships don't pay taxes on their profits;

This is why i like to use the sub accounts that you can roll up into the parent account, owner's equity. Open the chart of accounts and choose add. add a new equity account and title it owner's draws. if there is more than one owner, make separate draw accounts for each owner and name them by owner, e.g. To reimburse the owner immediately:

Any profit the business makes is reported as income on the owners' personal tax returns. If you own a business, you should pay yourself through the owner’s draw account. Writing letters with quickbooks 1.

What is the best way to handle the following. Using reminders and setting preferences 5. No owners draw or contribution.

We’ve added owners’ draws to the mappings in quickbooks desktop (it was already in qb online). Using the letters and envelopes wizard 2. On the credit card statement, it will show $50.00 charge and for that transaction $50.00 credit.

The funds are transferred from the business account to the owner’s personal bank account. It represents a reduction of owners' equity in the. I can use my points to wipe out that 50.00 charge.

Owner's equity represents the owners investment in the business minus the owners draws or withdrawals from the business plus the net income (or minus the net loss) since the business began. Owners’ draws in quickbooks desktop. Owner draw is an equity.

To write a check from an owner's draw account: Choose lists > chart of accounts or press ctrl + a on your keyboard. Enter the account name (owner's draw is recommended) and description.

Take care of business faster with docusign. To reimburse the owner later: All the withdrawals will be recorded in this account which is done by the owners.

With the help of an owner’s draw account, you are enabled to record any kind of withdrawals from the bank account. The draw is a way for an owner to receive money from the company without drawing a salary. Click create (+) > check.

Record your owner’s draw by debiting your owner’s draw. This way you will never miss any transaction done for or in favor of business growth. How user set up and use multi currency?

How to setup and pay owner’s draw in quickbooks online & desktop? Quickbooks records the draw in an equity account that also shows the amount of the owner’s investment and the balance of the owner’s equity. At the end of the year or period, subtract your owner’s draw account balance from your owner’s equity account total.

An owner’s draw is a separate equity account that’s used to pay the owner of a business. You have an owner you want to pay in quickbooks desktop. September 9, 2021 by james antonio quickbooks multi currency:

An owner’s draw is money that you transfer out of your business’s bank account and into your personal account. All business transactions are geared towards a sole proprietorship reporting taxes on the owner's personal 1040 + schedule c. For more details on how to record an owner’s draw in quickbooks, keep reading.

Accordingly, is owner's draw an expense or equity? But it shouldn’t be used for. Click create (+) > bill.

Recording an owner’s draw 3. A member’s draw, also known as an owner’s draw or a partner’s draw, is a quickbooks account that records the amount taken out of a company by one of its owners, along with the amount of the owner’s investment and the balance of the owner’s equity. Click to see full answer.

A member’s draw, similarly called an owner’s draw or partner’s draw, records the amount taken out of a company by one of its owners. For example, i charge 50.00 in meals to one of my credit cards. Print the check or enter the check number (for handwritten checks).

It is another separate equity account used to pay the owner in quickbooks. You don’t withhold payroll taxes from an owner’s draw because it’s.

Owners Draw Setup Quickbooks - Create Setting Up Owners Draw Account Qb

Setup And Pay Owners Draw In Quickbooks Online Desktop

How To Pay Invoices Using Owners Draw

Owners Draw Quickbooks Tutorial

Owners Equity In Quickbooks Desktop - Candus Kampfer

How To Record Owners Equity Draws In Quickbooks Online - Youtube

How To Record An Owners Draw - The Yarny Bookkeeper

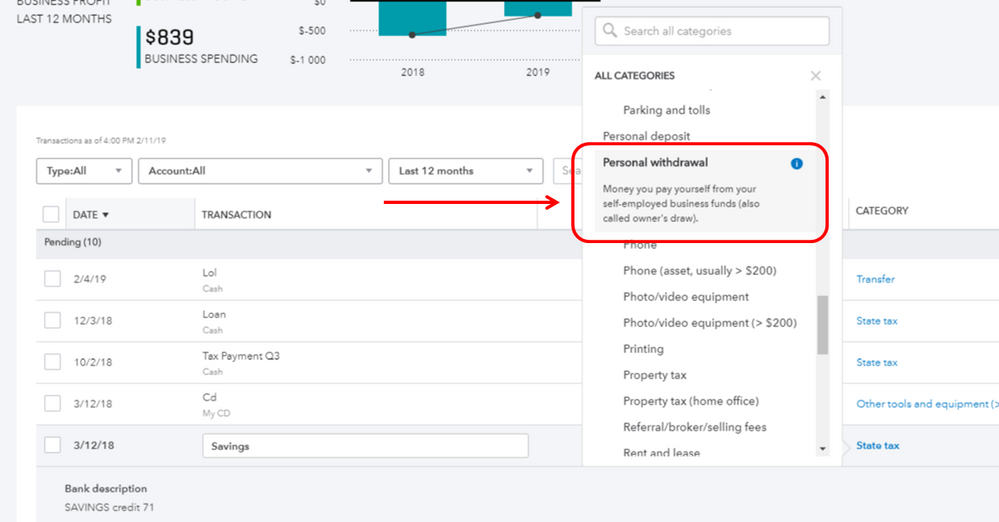

Solved Owners Draw On Self Employed Qb

Equity Account Showing Up In Budget

How To Pay Invoices Using Owners Draw

Solved Owners Draw On Self Employed Qb

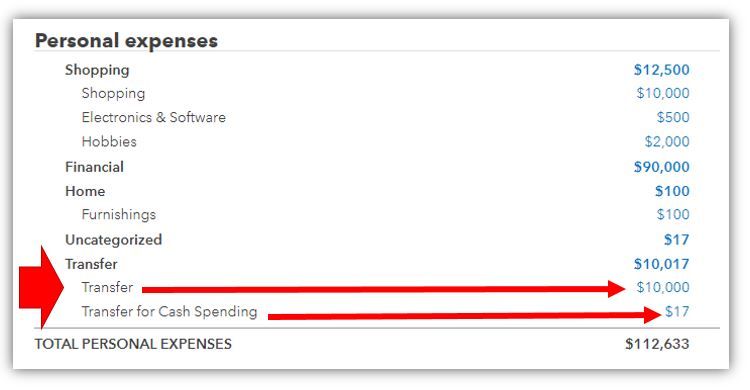

Owners Draw Balances

Setup And Pay Owners Draw In Quickbooks Online Desktop

Minutes Matter - In The Loop Paying Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Quickbooks Owner Draws Contributions - Youtube

How To Record Owner Investment In Quickbooks Updated Steps

How To Record Owner Investment In Quickbooks Updated Steps

How To Record An Owners Draw - The Yarny Bookkeeper

Quickbooks - How To Record Owner Contributions - Youtube